Pleo Updates

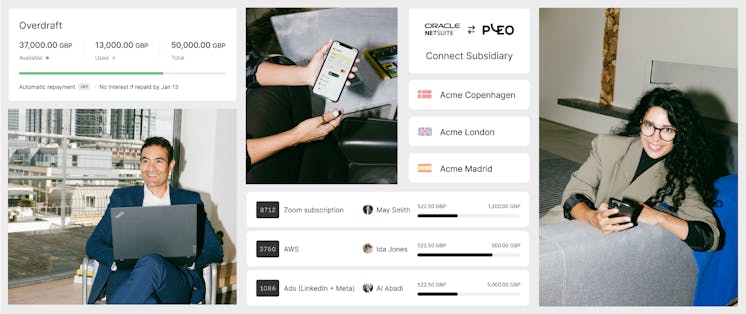

Mastering spend management: Easily manage recurring payments with Pleo’s Vendor cards

Your guide to understanding how Vendor cards can work for your business, saving you time and money when managing the digital services you re...

Pleo’s 2023 wrapped: More features, events and customers than ever before

Before we dive headfirst into Christmas and swap expenses for eggnog and cashback for carols, let’s take a look at some of our highlights of...

5 essential Pleo features we announced at our Beyond event

We’re always working hard to build genuinely useful features, and we see these five as key to helping our customers optimise their spend pro...

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&dpr=2&w=373)

Why you need to attend Beyond, our event to discover the new way of finance

Let us enlighten you on all there is to know about Beyond, from what to expect to exactly why you need to be there…

Why we're giving businesses their time back with Pleo Invoices

With Pleo Invoices, you’ll no longer need a separate invoice handling software alongside an expense software, alongside payment cards.

Process, pay, and bookkeep all your bills using Pleo Invoices

Invoices are a huge part of how companies spend money, and that’s why we’ve launched Pleo Invoices across Europe.

How Pleo’s spend controls can help you create business spending symphony

Rather than feeling out of control, how about relying on a system that gives you efficient workflows and a detailed view of every expense?

Get the Pleo Digest

Monthly insights, inspiration and best practices for forward-thinking teams who want to make smarter spending decisions

Powered in the UK by B4B partnership

.jpg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&dpr=2&w=373)